Global Aerosol Industry: Facts and Data

1.1 Aerosol Production and Structure

1.1.1 Global

According to FEA (European Aerosol Association) data (note: production data mentioned in this article are sourced from FEA unless otherwise specified), the global aerosol production in 2024 is approximately 16 billion aerosol cans. The top five countries in terms of production are the United States with 3.752 billion aerosol cans, China with 2.56 billion aerosol cans, the United Kingdom with 1.44 billion aerosol cans, Brazil with 1.225 billion aerosol cans, and Germany with 932 million aerosol cans.

1.1.2 United States

In 2024, the aerosol production reached 3.752 billion aerosol cans, ranking first in the world, with household goods accounting for 28%, personal care accounting for 22%, and food accounting for 16%.

1.1.3 EU

The aerosol production in 2024 is 3.46 billion aerosol cans (excluding UK production from 2024 onwards), of which personal care accounts for 47.8% and household goods account for 17.3%.

1.1.4 United Kingdom

According to BAMA (British Aerosol Manufacturers Association) data, in 2024, the UK produced 1.44 billion cans of aerosols, of which personal care accounted for 74%, aluminum cans accounted for 62%, and tin cans accounted for 38%.

1.1.5 Japan

According to the 10th issue of SPRAY magazine's electronic journal in 2025, Japan's aerosol production in 2024 was 504 million aerosol cans, of which personal care accounted for 49%, tin cans accounted for 52%, and aluminum cans accounted for 46%.

1.1.6 China

From 2014 to 2024, China's aerosol production increased from 1.554 billion cans to 2.56 billion aerosol cans, ranking second in the world. According to the 10th issue of SPRAY magazine's electronic journal in 2025, the number of cans of food aerosols in China has increased from 35 million in 2023 to 50 million in 2024 (a growth of 42.86%), while the number of cans of personal care aerosols has decreased from 460 million in 2023 to 450 million in 2024 (a decrease of 2.17%). The top three categories are industrial/technical automotive products (19.53%), paints and coatings (19.33%), and personal care (17.58%). The proportion of personal care, pharmaceuticals, and food is significantly different from that of Europe, America, and Japan.

1.2 Per capita annual usage of aerosols in various countries/regions

According to AEROBAL (International Organization of Aluminum Aerosol Manufacturers) data, the top five countries/regions in terms of per capita annual aerosol usage in 2023 are Argentina (17.7 cans), North America (10.2 cans), Australia (9.1 cans), Europe (7.1 cans), and Brazil (5.3 cans). China ranks 10th in the world with a per capita usage of 1.9 cans.

1.3 Production of aluminum aerosol cans

According to AEROBAL data, global aluminum aerosol can production increased from 7.625 billion cans in 2014 to 9.236 billion cans in 2024, with an average annual growth rate of 2% over the past decade, and a 4.2% increase in 2024 compared to 2023. Globally, aluminum aerosol cans account for nearly 60% of the total number of aerosol cans; China still relies mainly on tin cans, with aluminum cans accounting for less than a quarter.

1.4 Development and Challenges

The global annual production of aerosols has been hovering around 16 billion aerosol cans for many years, and there may be multiple influencing factors. One of the main factors is whether they can be disposed of environmentally friendly and safely after use, which has become an important factor affecting the willingness to purchase or use aerosol products, especially for the younger generation of consumers. The development of the aerosol industry faces many constraints, and recycling and reuse are the most prominent bottlenecks. Every year, humans consume a large amount of aerosol products, bringing convenience to people, but at the same time, a large amount of waste comes with it. How to safely, environmentally friendly, and efficiently recycle and reuse is a global challenge. Countries around the world are actively exploring recycling and reuse technologies to reduce the impact and harm of aerosol products throughout their lifecycle on the environment.

2.What else do we need for sustainable development

2.1 Our advantages

The internationalization level of China's aerosol industry is high, and it has been integrated into international cooperation and competition for a long time. More than ten years ago, it has become the world's second largest aerosol producing country, and its international competitiveness and influence continue to improve, with outstanding advantages.

2.2 Existing Problems

2.2.1 Capacity utilization rate

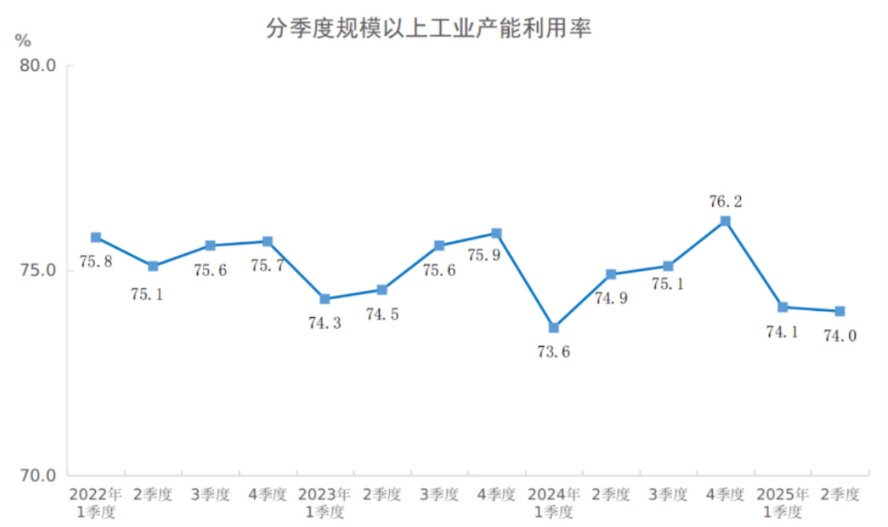

Since 2020, China's aerosol production has been hovering around 2.5 billion cans, but the production capacity has continuously broken records and is still rapidly increasing in recent years, especially in the cosmetics industry. According to data from the National Bureau of Statistics, the average capacity utilization rate of industrial enterprises above designated size in China is around 75%. What is the national utilization rate of aerosol production capacity? The real data may be shocking.

2.2.2 Lessons Learned

The utilization rate of aerosol filling and filling capacity is low, especially in the cosmetics industry. However, there are still many enterprises blindly investing in expanding production to increase capacity, and according to this trend, the capacity utilization rate will continue to decline.

Over the past decade, excessive competition in the tinplate aerosol can industry has harmed the entire sector. In recent years, aluminum aerosol cans have reappeared, with dozens of aluminum can factories emerging in the short term to share the actual demand of only 800 million aerosol cans per year. This has led to vicious competition at low prices, and a well-established industry is now facing an unprecedented crisis.

2.4 Shortcomings that need to be supplemented

The hardware equipment, production process, formulation technology, quality control, and standardization of aerosol factories in China mostly refer to and draw on the experience of Europe and America. Compared with Europe, America, and Japan, there is a visible generation gap that urgently needs breakthrough progress, including:

1. In terms of key equipment: high-speed production lines with 250 cans/min or more, high-purity filling equipment, 5-station tinplate combination machine, aluminum can necking machine with 30 or more workstations, 9-color printing machine relying on imports

2. Core materials: high-end coatings, high-end essence, HFO propellants, inner gaskets of aerosol valves, aerosol valves for inhalation drugs, aluminum blocks for aluminum cans and other domestic products have not yet been completed

In terms of high value-added products, the proportion of high value-added products such as food, medicine, medical equipment, and personal care products is low, and there are not many original and independently intellectual property products

3. In terms of independent brands: OEM/ODM accounts for a high proportion, but there are still few independent brands. The global layout of going global has just begun, and brands with international influence and competitiveness are even rarer

4. In terms of standards: Relevant national and industry standards are outdated and significantly lagging behind. For example, the current aerosol safety production standards refer to FEA's 2.0 version regulations released in 2002, which have been lagging behind for more than 20 years